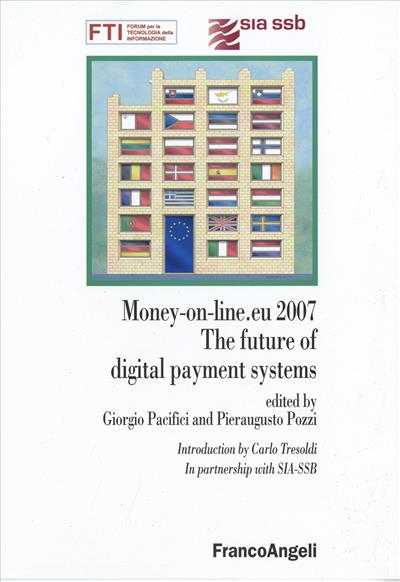

Fti-Forum per la Tecnologia dell'Informazione

A cura di: Giorgio Pacifici, Pieraugusto Pozzi

Money on line. eu 2007

The future of digital payment systems

This book deals with the theme of payment systems in Europe, where the payment systems are going to be regulated by new rules: the Payment Systems Directive (PSD), that should be adopted by the member countries by 2009, is converging with the banking industry selfregulation, the Single Euro Payment Area (SEPA) and both of them imply a basic policy revision in the actual banking system cost models.

Edizione a stampa

33,50

Edizione a stampa

33,50

Pagine: 288

ISBN: 9788846489913

Edizione: 1a edizione 2007

Codice editore: 571.2.11

Disponibilità: Discreta